Get Free Trial Week Developer Access, Try Before You Hire. Click Here to Claim Now

Customer:

Our client is a UAE-based fintech company that offers digital financial solutions for both individual consumers and businesses. As they are in this industry for many years, they have already established themselves as a reliable provider of mobile recharge and online bill payment services.

But their existing payment systems were limited and traditional in nature. Since a few months, they noticed customers were facing issues in completing basic transactions like paying bills or transferring money, because the platform lacked intelligence and personalization.

Cashless payments is growing fastly in every country, and every small business is now using AI. Soon our client realized that their business looks old-fashioned and need to start using cashless payments for their financial services.

Hence, they approached Manektech for a reliable mobile application development solution. During the discussion, the client mentioned their goal was to create a next-generation digital wallet app which should offer insights, security, and a personalized user experience.

Plus, they also wanted world-class security with predictive fraud detection.

A Challenge to Build a eWallet App Platform:

The client already used the digital wallet, but it was an old and outdated one. It was designed mainly for basic tasks like bill payments and money transfers, and it also lacked the smart features that modern users expect today.

From a business perspective, the biggest issue was low customer engagement. Users opened the app only to pay bills or transfer money, but there was nothing that encouraged them to return back. The competition in the UAE fintech market is highly growing as other apps already provide advanced features. It was important for our client to upgrade their with something extraordinary.

Another concern was security. Many customers were scared of fraud or scams, hence we needed to implement end-to-end encryption and strong security protocols.

On the development side, the challenges were equally complex. The client demanded to integrate AI models for fraud detection and financial insights. Plus the app should also support multi-currency transactions for international users. They had to ensure strict compliance with the UAE Central Bank regulations for data security. The wallet also needed to work seamlessly across iOS, Android, and web, and integrate multiple payment gateways like Visa, Mastercard, PayPal, Apple Pay, and Google Pay without compromising speed or safety.

Best AI Digital Wallet Solution Implemented By Our Team

To solve the above challenges, we had a meeting with the client to understand how their business works, who their customers are, and currently where they are lacking. We compared other e-wallet platforms in Dubai to know how they are unique and have advanced features. We also mentioned app development costs and some of the doubts by client, such as

- How much does it cost to develop an eWallet app?

- How long does it take to build an eWallet app?

- What features should an eWallet app have?

The brief discussion gave us a clear idea of what they really need.

We added useful features like AI-driven spending insights, fraud alerts, multi-currency support, and a scalable design for expanding business.

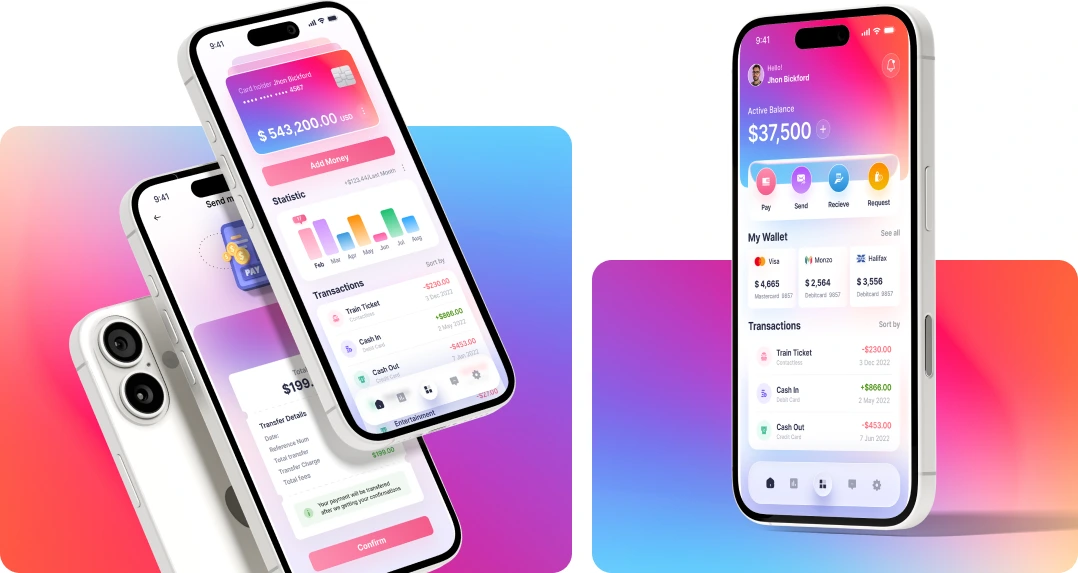

Experienced as flutter app development company UAE, we selected Flutter to target iOS and Android users. For the backend, we used Node.js and MongoDB to handle high transaction volumes. We build AI models using Python and TensorFlow to add real intelligence to give budgeting suggestions, flag suspicious activity, and even remind users about upcoming bills.

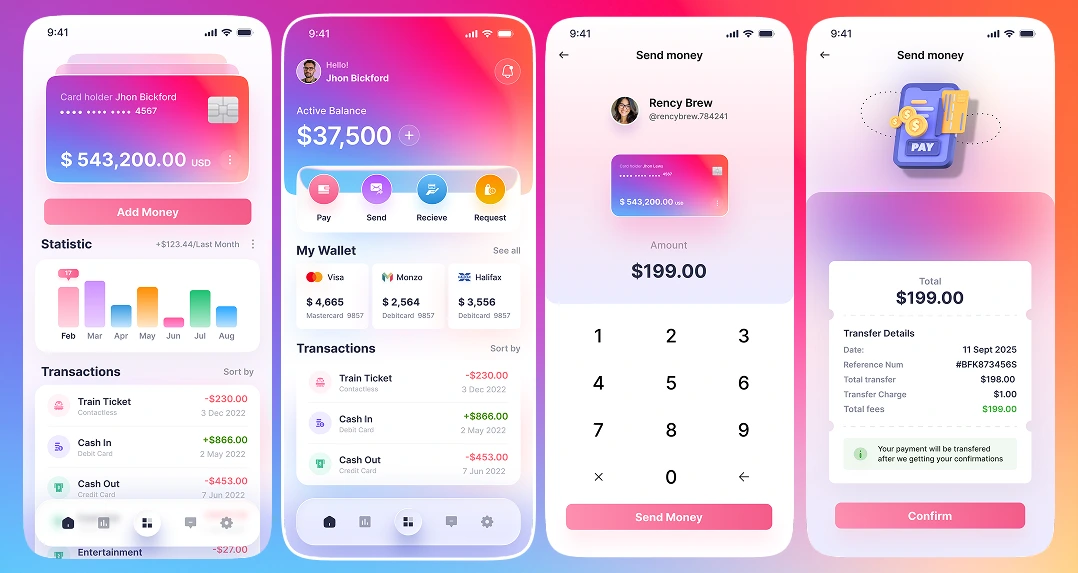

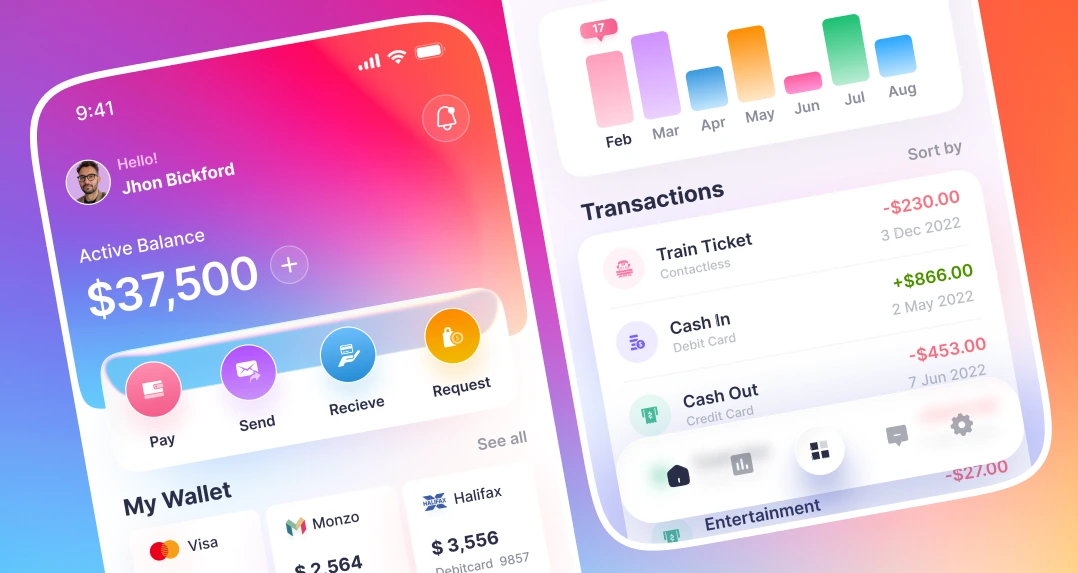

Our designers suggested to keep the design modern with simple navigation, dark and light modes, and one-click payments. As most of the UAE people speak English and Arabic, we kept this as the main language.

Key Features of Digital Wallet App:

- Sign-Up: Users need to create an account to access the wallet using phone or email verification.

- AI-Powered Spending Insights: It will track daily spending and provide personalized financial advice.

Fraud Detection & Alerts: This digital wallet app uses AI, which will monitor and notify if there is any suspicious fraud activity with your finances. - Multi-Currency Wallet: You can make transactions in AED, USD, EUR, and other major currencies.

- Bill Payments & Mobile Recharge: It can be used for bill payments, recharge, and other quick utilities.

- Biometric Authentication: If you don't want to handle signing in a password, you can log in securely with Face ID or fingerprint.

- Smart Budgeting Tools: The app also provides AI-generated monthly reports and budget suggestions.

- Loyalty & Rewards Integration: Personalized offers from partner stores and cashback rewards.

- Seamless Payment Gateway Integration: It supports Visa, Mastercard, PayPal, Apple Pay, and Google Pay.

Result of AI Digital Wallet App:

Within the 3 months of the launch of this best ewallet app, the client saw noticeable results. Here they are:

- 40% increase in new user registrations within the first 3 months.

- Fraud transactions reduced by 70% because of smart detection.

- Users started logging in more frequently for spending insights and rewards.

- 25% increase in revenue through partnerships, loyalty programs, and transaction fees.

Technologies and Tools:

- Frontend: Flutter

- Backend: Node.js, Express.js

- Database: MongoDB

- AI/ML: Python, TensorFlow

- Cloud: AWS

- Payment Gateways: Stripe, Visa, Mastercard, PayPal

- Security: AES-256 encryption, Biometric login

Are you Interested in Creatin A Similar App for Digital Payment?

Our consultants are ready to hear your ideas. Request a free consultation with our software & app experts and transform it into a digital reality.

Share it on:

Suggested Case study

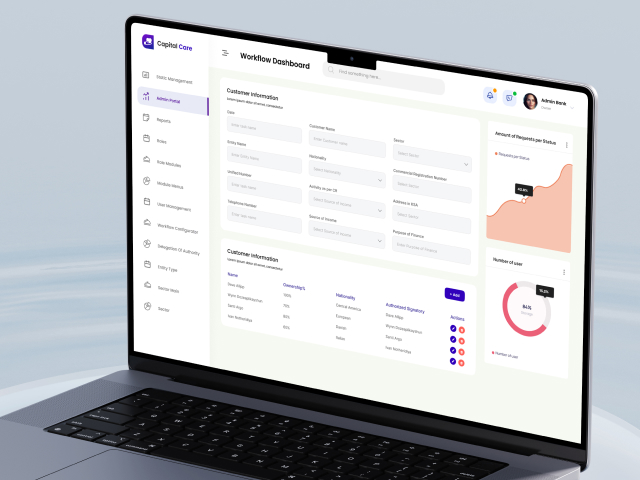

Capital Care: Loan Tracking Software

Single solution for all financial services such as Loan tracking software application process just like Neobank.

Investment Management Software Development

Being a trusted software development company in the USA, we developed the best investment management software to help our finance advisory client with easy finance tracking, reporting, and management of other operations. It offers secure client access, automated report generation, and incorporates real-time market data. We added risk analysis tools, multi-asset aggregation, and compliance tracking features to get the latest investment insights as per trends.