Get Free Trial Week Developer Access, Try Before You Hire. Click Here to Claim Now

Customer:

Our client is a mid-sized financial advisory company in Dubai, providing wealth management services to institutional and high-net-worth investors. The firm was having trouble effectively managing, tracking, and reporting on investment performance due to its expanding clientele and more diverse portfolios. They were using common tools like Spreadsheets, simple CRMs, and outdated financial software for current use, but this was lacking intelligent insights and real-time data integration. Hence, this resulted in frequent Inaccurate forecasts, a heavy administrative load on their employees, and delays in client reporting. Client collaborated with us to develop a centralized, user-friendly, and secure investment management platform that was customized for their business model after realizing the necessity of digital transformation. The client said their aim behind developing this Investment Management Platform is to achieve visibility, increase operational effectiveness, and provide high-value insights to their users.

A Challenge to Create a Investment Management Platform:

The client was facing several difficulties with tracking investments and running their business. Firstly, the advisory team did not have a single, integrated view of the investment portfolios of their clients. And the assets and data were stored in different platforms, hence it was problematic to get information and analyze the performance when required.

Also, the client used to follow manual entry and reconciliation procedures, which were frequently causing errors. Hence, due to inconsistent and wrong manual entry, the internal workflow was getting slow, and also the client’s investment was affected due to not taking the right action at the right time.

Our dedicated developers also faced minor challenges in designing a solution as the client wanted a sophisticated software design while preserving the functionality like financial regulation compliance, secure aggregation, and financial data syncing from various third-party API.

Also, the client has a growing business, so the software has to be scalable. To secure the user-access and data security, we needed to create a strong architecture that could manage huge amounts of real-time data and provide useful analytics for advisors and clients.

Cloud Based Investment Portfolio Management Software Implemented By Our Team

Being a leading offshore software development company, building investment portfolio management software was not a big deal, as we already have expertise in serving the fintech industry. We had an online meeting with the client to understand their finance advisory business, who their users are, and their current style of working. The main requirement was to offer users with the right insights data using analytics. Our team integrated various platforms to connect data sources to give users insights to make profitable decisions. We also implemented AI and features like data aggregation, portfolio tracking, and report generation to predict the outcome by fetching the current data.

We chose a microservices architecture to solve the scalability issue and to accommodate increasing user and data loads.

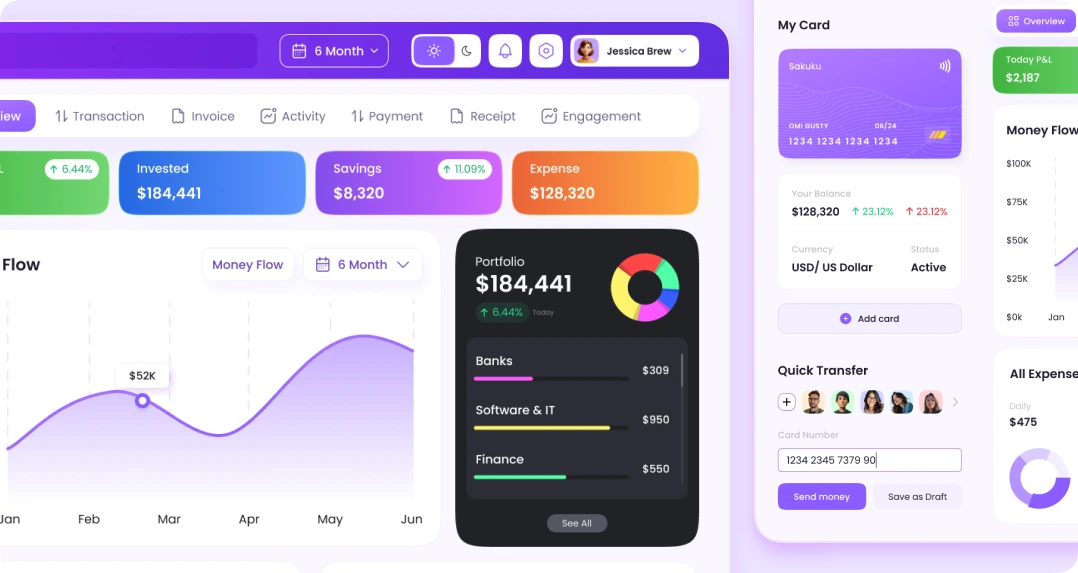

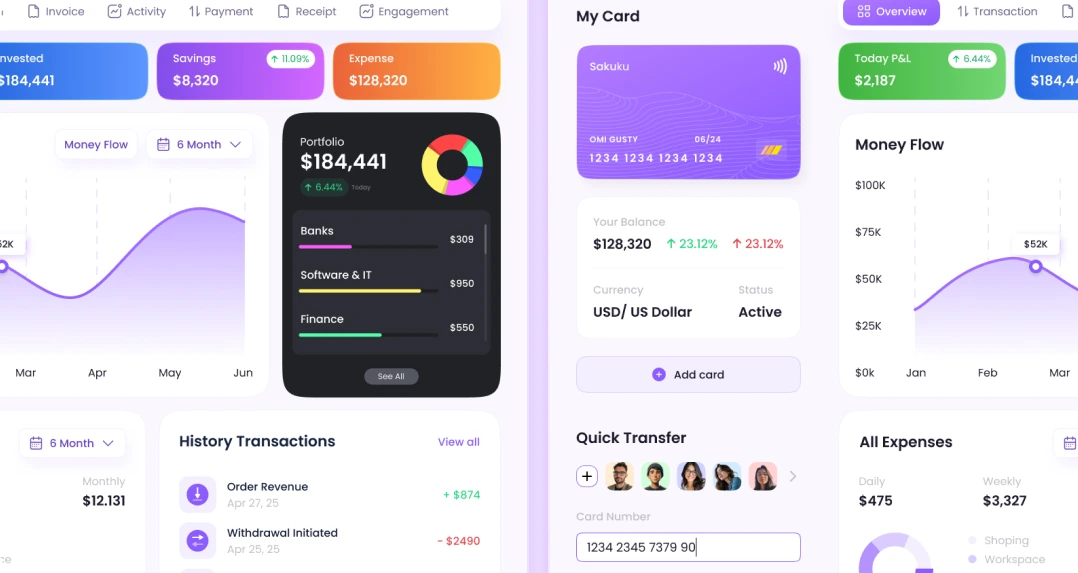

Keeping security and privacy in mind, we created role-based dashboards for the internal team of the client to automate tasks like risk assessment, performance analysis, and rebalancing recommendations.

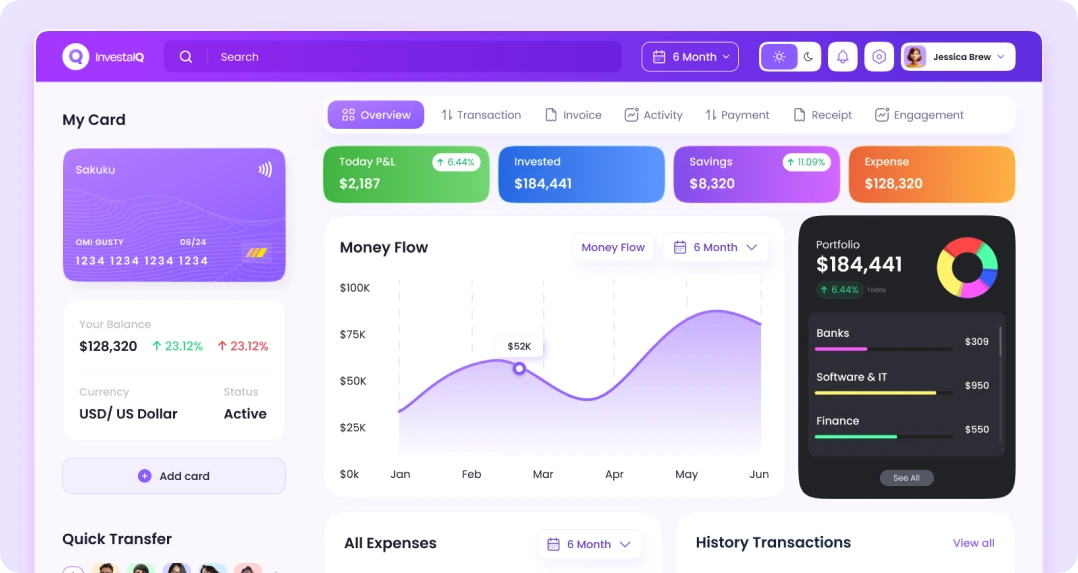

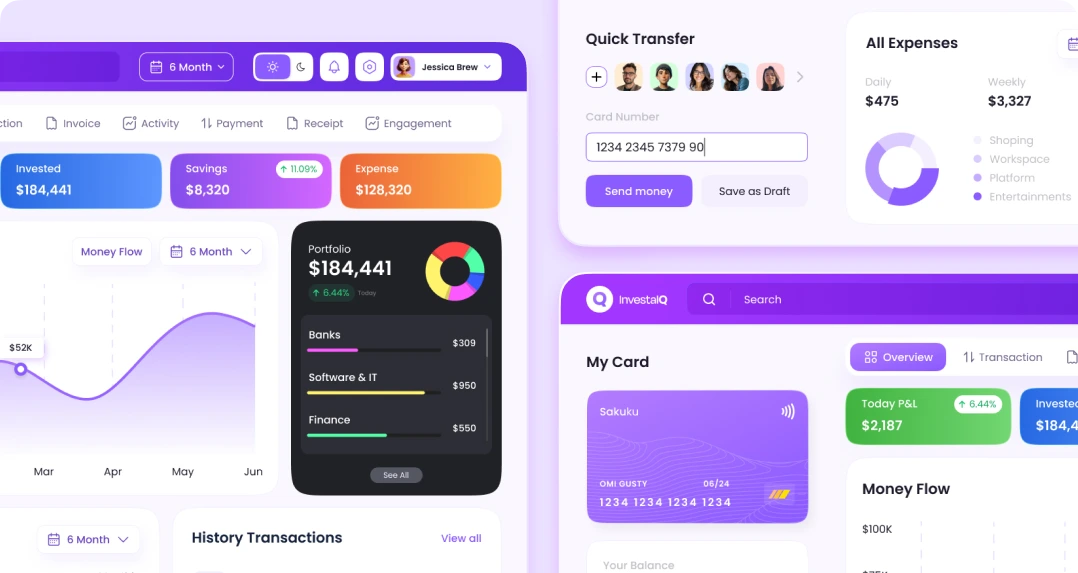

Plus, we developed customized portals for end users that offered clear visual displays of asset allocation, investment performance, and historical trends.

Key Features Investment Fund Management Software:

Below are key features we implemented in this Investment management software.

- Dashboard for Portfolio Aggregation: This provides a consolidated view of all investments across platforms and asset classes.

- Integration of Real-Time Market Data: Users can see up-to-date information on market trends, fund NAVs, and stock prices.

- Client Portal Access: Investors and other users can access the portal to monitor their holdings and obtain reports.

- Automated Report Generation: Users can generate reports related to on-demand tax, compliance, and performance reports.

- Risk Assessment Engine: Users can use tools for evaluating portfolio volatility and risk tolerance.

- Rebalancing Suggestions: Warnings for advisors to keep their asset allocation strategic.

- Compliance Tracking: Integrated notifications for documentation, reporting due dates, and regulatory limits.

- Multi-user Access Management: We added role-based access controls for advisors, clients, and administrative staff.

- Secure Data Storage: This includes disaster recovery and data backup features in addition to end-to-end encryption.

- Analytics & Insights: AI-powered tools for scenario modeling, benchmarking, and forecasting.

Result of Investment management software:

As a top custom software development company, we have years of expertise and mastery in building custom softwares for many industries including fintech, banking, ecommerce, and more. Our client was satisfied with the results of this investment management software.

- Within the first three months, operational efficiency increased by 40%.

- With automation and real-time data syncing, advisors were able to save more than ten hours every week.

- Audit risks were lowered by 30% thanks to better compliance tracking.

- Enhanced client reporting led to a 25% boost in retention rate.

- Better investment choices and portfolio rebalancing resulted in a 15% increase in revenue for the client in just six months.

- Successfully managed over $500 million in assets across 4,000+ client accounts using the new platform.

Technologies and Tools:

- Frontend: React.js

- Backend: Node.js, Express.js

- Database: PostgreSQL

- Cloud: AWS

- DevOps: Docker, Kubernetes

Are you Interested in Creating A Similar Wealth Management Platform?

Our consultants are ready to hear your ideas. Request a free consultation with our software & app experts and transform it into a digital reality.

Share it on:

Suggested Case study

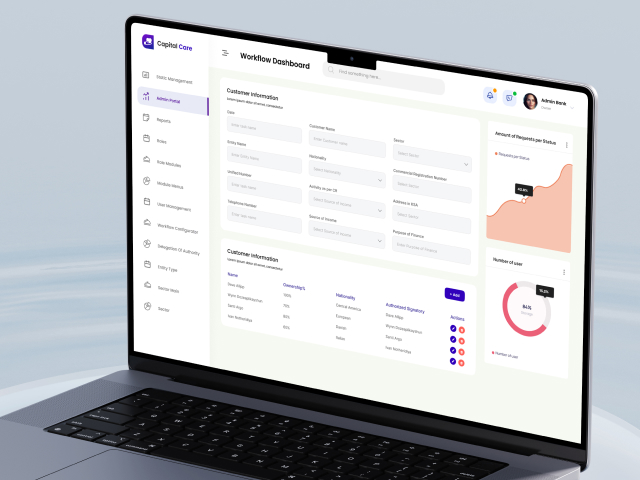

Capital Care: Loan Tracking Software

Single solution for all financial services such as Loan tracking software application process just like Neobank.

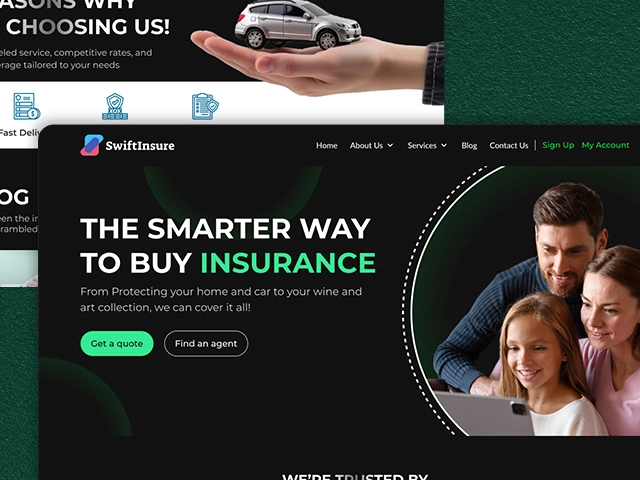

SwiftInsure: Insurance Provider Website

Bridging insurance gap seamlessly with Angular-PHP-MySQL technology stack.